Debt Collection Software

Introduction - What is Debt Collection Software?

Navigating the financial management landscape as a business professional seeking to optimize processes and reduce operational costs can be challenging. In your search, you've likely encountered debt collection software. This guide serves to clarify what this kind of software entails, detailing its functionality, advantages, and how various solutions compare. This information is crucial if you aim to stay ahead of late payments and maintain a competitive edge in the fast-paced market.

Definition of debt collection software

Debt collection software, which falls under the broader category of financial management software, is also known as Accounts Receivable Management (ARM) software. This comprehensive solution is designed to streamline debt recovery workflows, offering a holistic view of all debt collection activities and debtor-creditor interactions.

Debt collection software is a technological solution that automates and manages the process of recovering overdue payments from individuals or businesses.

Essentially, it's a type of accounts receivable software that integrates with a CRM, a loan servicing system, or a customer portal. Debt collection software not only simplifies regulatory compliance but also enables analytical-driven optimization of debt collection processes, contributing to an efficient credit management system.

The Late Payment Challenge: A Global Concern

The problem of late payments is proliferating across businesses worldwide, inflicting significant financial stress and disrupting cash flow. In 2022, it was observed that the average payment terms had extended from 33 days in 2019 to 37 days. Similarly, the average invoice payment delay also spiked from 21 to 23 days, leading to global revenue losses over 3% written off as bad debt.

This challenge strikes universally, affecting small to mid-sized businesses particularly harshly. For instance, US-based mid-sized firms reported an average owed amount of $304,066 from late-paying customers, with 81% experiencing a surge in late payments since 2021. These overdue invoices cost these businesses approximately 14 hours weekly in follow-ups.

This ripple effect curbs cash flow, forcing businesses to tap into their reserves or seek loans, both of which compromise long-term financial stability.

Considering the turbulent economic climate during COVID-19 and the subsequent recession, about 40% of businesses faced worsening late payments and insolvencies doubled. In the face of an impending global recession, it's imperative for businesses to evaluate their late payment challenges and deploy practical solutions to minimize them.

Here are some insights from the 2022 late payments report, emphasizing the severity of late payments:

- Almost 90% of businesses typically receive payments post the due date of their invoices.

- Only 13% of respondents were paid on or before the due date.

- Businesses from China, New Zealand, the United Kingdom, Pakistan, and South Africa reported the fastest payments, waiting on average just a week post the due date.

- Marketing, advertising, and construction industries suffered the most from late payments, with 60% of invoices paid 15 or more days late.

- While smaller businesses generally receive payments one to two weeks post the due date, businesses with over 500 employees typically wait up to 30 days post the due date.

Nevertheless, solutions are at hand to reduce the waiting period for payments. Users of accounts receivable and debt collection software were three times more likely to receive invoice payments before the due date.

How do businesses manage the debt recovery process today?

Interestingly, only a small fraction of European businesses outsource their entire receivables process. Most enterprises employ a combination of internal and external resources, including financial management software and external service providers, to handle accounts receivable. Thus, debt collection generally involves a blend of internal resources, external resources (such as a debt collection agency or attorney), or even selling the debt.

Challenges faced by collection teams

Debt collection teams often face numerous obstacles in their quest to recover debts, some of which can be mitigated with a comprehensive collections system. Some of the most common challenges include:

- Inability to make customer contact: Often, customers dodge communication attempts, making it challenging for collection agents to initiate debt recovery. However, a well-implemented collections system or debt collection software can streamline customer engagement and reduce this issue significantly.

- Low debt recovery rate: Outstanding payments and bad debts can have a devastating impact on a company's cash flow, revealing inefficiencies in the collection process. However, digital outreach, automated reminders, and the use of advanced accounts receivable software can accelerate debt recovery.

- Errors with manual tasks: Manual tasks can be prone to errors, especially as the number of high-risk accounts increases. A proficient debt collection software or debt management system can help automate routine activities and prioritize tasks based on account risk, minimizing manual errors.

- Fractured customer connect: Maintaining empathy while handling debt collection is key to fostering strong customer relationships. Automated communication during the initial stages of debt recovery and the provision of self-service payment portals can mitigate the pressure on customers. A comprehensive debt collection software helps you to design each stage of customer engagement, simplifying the process for both the customer and the collector.

Key Advantages of Employing Debt Collection Software

Embracing automation with debt collection software is a strategic move that any business dealing with accounts receivable should consider. This powerful tool, part of the broader financial management software ecosystem, offers a suite of benefits designed to streamline your processes, improve the efficacy of your recovery efforts, and ensure the security of sensitive customer data. Furthermore, it provides crucial insights, enhancing your financial reporting capabilities and fostering healthier customer relationships.

Typical ROI of implementing an automated debt collection solution includes:

- Up to 65% reduction in debt collection costs.

- Accelerated debt collection processes by up to 8 times.

- Productivity growth in debt recovery teams by 3-4 times.

- A sevenfold increase in debtor response rate.

- Reduction in Days Sales Outstanding (DSO) by over 40%.

- 20% decrease in bad debt

Below, we'll delve into each of these benefits, shedding light on how they can revolutionize your debt recovery strategy and bolster your financial management.

- Time Efficiency Through Automation: Debt collection software eliminates the tedium associated with manual debt recovery tasks. Instead of calling customers individually or laboriously updating spreadsheet records, the software handles these tasks automatically. This automation frees up time for your team to focus on more strategic efforts, making the entire process more efficient.

- Enhanced Recovery Rates with Optimized Collection Process: In the realm of credit management, efficiency is paramount. Debt collection software steps up to the plate, simplifying the collection process, tracking payments in real-time, and providing ready access to critical collections data. This harmonization leads to faster resolution of overdue accounts and an overall increase in recovery rates.

- Data Consolidation: Legacy systems often lead to data silos that can hamper effective debt recovery. By centralizing data in one place, debt collection software provides a holistic view of a customer's journey, enabling better customer service and reducing risk. It's a core component of a holistic collections system, ensuring seamless integration and data flow.

- Insightful Analytics: When it comes to debt management, data-driven decision-making is crucial. By digitizing your collections process, you can leverage the wealth of analytical insights that debt collection software provides. This can help to streamline your operations, optimizing collection strategies for different borrower segments and improving overall performance.

- Improved Customer Relations: Debt collection software is not only a tool for the benefit of businesses; it's also a platform that enhances the customer experience. By ensuring fair treatment and efficient communication during the debt recovery process, this software improves customer relationships, fostering trust and loyalty.

- Robust Financial Reporting: With debt collection software integrated into your financial reporting software suite, you gain an all-access pass to your financial data. This enables accurate, up-to-date reporting and informed decision-making about debt portfolio strategies. Consequently, this leads to better financial management and improved business outcomes.

- Superior Security and Regulatory Compliance: Debt collection software incorporates robust security measures, including encryption technology and two-factor authentication protocols, to safeguard sensitive customer data. Additionally, it ensures regulatory compliance by keeping track of changing laws and alerting possible violations. This combination of security and compliance guarantees your business can operate within legal parameters while maintaining trust with your customers.

- Impressive Return on Investment (ROI): Investing in debt collection software is a decision that pays dividends. The software leads to significant reductions in collection costs and DSO, improved productivity, and higher debtor response rates. Furthermore, it results in decreased bad debt, reflecting positively on your bottom line.

Best practices

Key Characteristics of an Effective Debt Collection Automation System

As financial management evolves with technology, utilizing a sophisticated debt collection automation system has become a necessity. These systems are designed to streamline operations, reduce manual labor, and improve debt recovery rates. This section details the fundamental features of a comprehensive debt collection system. From complete borrower management and effective case distribution to streamlined task management and robust security compliance, these key characteristics are designed to enhance the efficiency of the debt collection process. Let's delve into these features to understand their significance in automated debt collection.

Comprehensive Borrower Management

A debt collection system offering complete borrower management gives agents the necessary tools to establish effective communication with debtors. This approach incorporates various stages of the borrower lifecycle such as onboarding, segmentation, debt recovery prediction, and case closure. By integrating with data exchange APIs such as LOS, CIBIL, Experian Hunter, Perfios, and NetBanking Connect, the system consolidates borrower information, which enhances future interactions. The software also allows for the seamless importing of existing cases from other platforms. A dynamic collections system utilizes Days Past Due (DPD), credit repayment history, due amounts, and repayment intent to segment borrowers, aiding in the formulation of tailored collection strategies.

Key features include:

- Consolidation of borrower information through various data exchange APIs.

- Segmentation of borrowers using Days Past Due (DPD), credit repayment history, due amounts, and repayment intent.

- Seamless import of existing cases from other platforms.

- Lifecycle management, covering stages such as onboarding, segmentation, prediction, and case closure.

Effective Case Distribution

For financial firms dealing with multiple debtor profiles, debt collection software offers robust workflow automation tools. These assist in mapping and distributing cases based on factors such as collector availability, geographic location, and debtor priority. By ensuring that high-priority debtors are dealt with first, these automation features prove particularly valuable for smaller businesses with limited resources.

Key features include:

- Workflow automation for efficient case mapping and distribution.

- Prioritization of cases based on collector availability, debtor priority, and geographic location.

- Enhanced focus on high-priority debtors, beneficial for businesses with limited resources.

Simplified Agent/User Management

The software simplifies the management of both first-party and third-party collection agencies involved in debt recovery. With a robust call center lifecycle management system, debt collection software can automate numerous tasks based on call-center documentation, such as sending emails for urgent action or assigning field agents for non-responsive debtors. Further boosting efficiency, collections CRMs provide ready-to-use templates for various communication methods. The software also offers features that optimize field agent productivity, such as day planners, reminder notifications, and route guidance, all of which can be accessed via web-based or mobile CRM.

Key features include:

- Automation of various tasks through robust call center lifecycle management.

- Availability of ready-to-use templates for various communication methods.

- Features to optimize field agent productivity, including day planners, reminder notifications, and route guidance.

Strategic Debt Collection Planning and Optimization

The software's automated features enable the identification of debts for collection based on real-time data analysis, debtor segmentation and scoring, and prioritization of debts based on factors such as aging, amount, and risk. AI-powered recommendations provide insights on optimal strategies, allowing for scenario modeling and what-if analysis. Additionally, debt collection schedules can be automatically created, aiding in task management.

Key features include:

- Real-time data analysis for debt identification and debtor segmentation.

- AI-powered recommendations for optimal collection strategies.

- Automated creation of debt collection schedules to aid task management.

Streamlined Task Management

Debt collection automation systems ensure seamless assignment of tasks to collectors based on various criteria, including qualification, availability, schedule, and location. The system also allows for rule-based routing of debtor calls and requests, setting personalized KPIs, and providing dashboards for collectors to keep track of their assigned tasks.

Key features include:

- Seamless assignment of tasks based on various criteria.

- Rule-based routing of debtor calls and requests.

- Personalized KPIs and dashboards for collectors to track their tasks.

Seamless Communications Automation

Features like template-based creation of textual reminders, automatic sending of personalized payment reminders, and AI-powered capturing and processing of debtor responses enable efficient communication automation. Instances where integrated chatbots or IVR bots fail to recognize debtor responses can be routed to human agents for processing.

Key features include:

- Template-based creation of reminders and automatic sending of personalized payment reminders.

- AI-powered capturing and processing of debtor responses.

- Routing of unrecognized responses to human agents for processing.

Rigorous Debt Collection Control

A strong debt collection system includes comprehensive audit trails of collection-related activities, real-time tracking of received and outstanding debt repayments, and AI-powered verification of compliance with internal collection policies.

Key features include:

- Comprehensive audit trails of collection-related activities.

- Real-time tracking of received and outstanding debt repayments.

- AI-powered compliance verification with internal collection policies.

Efficient Debt Enforcement Automation

The software automatically initiates debt enforcement actions, generates and sends enforcement notices to debtors, and creates debt repayment arrangements. It also aids in debt restructuring, purchase, sale, and bad debt write-off.

Key features include:

- Automatic initiation of debt enforcement actions.

- Generation and sending of enforcement notices to debtors.

- Assistance in debt restructuring, purchase, sale, and bad debt write-off.

Proactive Dispute Management Automation

Automation features capture and validate debt-related claims and documents, aiding in decision-making about claim approval or denial. Debtors are notified about approved and denied claims, with credit memos assigned in case of valid claims.

Key features include:

- Capture and validation of debt-related claims and documents.

- Automated notifications about approved and denied claims.

- Credit memo assignments in case of valid claims.

Advanced Debt Collection Analysis

In the world of debt collection, data-driven decision-making is pivotal. Advanced Debt Collection Analysis provides a mechanism to compute and visualize essential KPIs like total recovered debt amount, debtor response rate, and outstanding payment amount. The system harnesses AI to suggest strategy adjustments, thereby enhancing the overall efficiency of the recovery process. Machine Learning aids in predicting crucial parameters like expected payment dates and recovery rates, offering insights for future planning. Regular reporting on received, delayed, and missed debt repayments empowers stakeholders to understand the effectiveness of their collection strategies.

Key features include:

- Computation and visualization of key KPIs.

- AI-driven suggestions for strategy adjustments.

- Predictive analytics for parameters like expected payment dates and recovery rates.

Robust Security and Compliance

Ensuring stringent security and regulatory compliance forms the backbone of any reliable debt collection system. The software is designed to comply with relevant global, country, and industry-specific regulations like the FDCPA, TCPA, and GDPR. Advanced features such as AI-based fraud detection and data encryption protect against data breaches, enhancing system integrity. Multi-factor authentication and role-based access control mechanisms add further layers of security. In addition, a Quality Management System (QMS) can be implemented to audit, measure, and improve the quality of calls, contributing to better communication practices and improved results.

Key features include:

- Compliance with global, country, and industry-specific regulations.

- AI-based fraud detection and data encryption for enhanced security.

- Multi-factor authentication and role-based access control mechanisms.

- Optional implementation of a Quality Management System (QMS) for call quality assurance.

Automated Payment Collections

The Automated Payment Collections feature takes the hassle out of debt repayment. It enables users to set up and manage payment schedules from customers, thus streamlining the process and reducing administrative burdens. This means debtors can pay off their debts in an organized, predictable manner, which benefits both the debtor and the creditor. Furthermore, to cater to the various financial circumstances of debtors, the software integrates with multiple payment processing platforms, offering a broad range of flexible payment options.

Key features include:

- Setup and management of customer payment schedules.

- Integration with multiple payment processing platforms.

- Broad range of flexible payment options to cater to various debtor circumstances.

Efficient Call Logs and Notes Management

An integrated dialer solution is a significant part of the debt collection system. Efficient Call Logs and Notes Management are crucial for maintaining a clear record of all debtor interactions. This feature assists agents by prioritizing calls based on their potential Return on Investment (ROI), thereby maximizing productivity. It also allows agents to plan callbacks, record conversations for training or record-keeping purposes, and make notes to ensure comprehensive follow-up. This systematized approach to call management boosts the effectiveness of communication between the agency and debtors.

Key features include:

- Prioritization of calls based on their potential Return on Investment (ROI).

- Planning of callbacks and recording of conversations for training or record-keeping.

- Note-taking feature for comprehensive follow-up.

more articles about key features

Essential Integrations for an Automated Debt Collection System

Integrations are the backbone of an automated debt collection system, enhancing its efficiency, accuracy, and minimizing human intervention. Below, we discuss the pivotal integrations that can help streamline debt collection activities:

- Accounts Receivable Software: An integration with an Accounts Receivable Software can automate the triggering of debt collection procedures while keeping the collection agents updated on debt repayment progress. It allows for accurate recording of due payments during debt extension, restructuring, and selling or purchasing agreements. This integration also enables timely write-offs of bad debts, ensuring a clean and efficient tracking system.

- CRM or Loan Servicing System: Whether it's a Customer Relationship Management (CRM) system or a loan servicing system, either of these integrations can facilitate data-driven debt collection planning. It automates the input of up-to-date debtor information in collection notifications, repayment agreements, and other related documents. This helps keep sales agents informed about debtor performance, enabling them to promptly initiate service termination or limit access to certain products in case of non-payment.

- Customer Portal: Customer portal integration is designed to streamline communication with debtors and expedite the delivery of debt-related documents. It automates the processing of debtor-submitted information, reducing manual labor and increasing efficiency. In some cases, the customer portal may be a part of the core functionality of the debt collection system.

- BI Solution: Integrating with a Business Intelligence (BI) solution can provide a leverage to debt collection data, enabling enterprise-wide analytics. This can help uncover patterns and trends in debt collection, helping to strategize and optimize processes. Some debt collection systems come with a built-in BI solution, adding value to their core features.

- Communication Channels: Communication is key in debt collection, and the integration of various communication channels can aid this. Email, messaging services, and auto dialing systems, for instance, can facilitate quick and easy outreach to debtors, enhancing the chances of prompt response and ensuring no debtor is left untouched.

- Credit Rating Platforms: Credit rating platforms, such as those provided by Experian and Equifax, can offer invaluable insights into a debtor's financial health. This includes updated credit rating dynamics, bankruptcy status checks, and enables quick credit report submissions. Integration with these platforms ensures the debt collection process is as informed as possible.

- Payment Processing Platforms: Smooth transaction processes are vital in debt collection. Integration with flexible payment processing platforms can allow for easy processing of payments by debtors and effective handling of payouts to creditors.

- CVS Upload/Download: Custom analytics and seamless data import/export can be achieved through CVS file upload/download capabilities. It's essential that the debt collection software allows for easy import and export of data in the form of CVS files, ensuring that users can effectively manage their data.

- API Integration: A well-documented, modern, and flexible API is crucial for building custom integrations with your existing tech stack. Most cloud-based debt collection systems will come with a set of default integrations, but to fully leverage the potential of the system, a robust API is a must.

What Is the Cost of a Debt Collection Automation Solution?

Understanding the cost of implementing a debt collection automation solution is crucial for any business that aims to optimize its operations. This section delves into the numerous factors that influence these costs, and emphasizes the importance of considering both the initial investment and long-term implications of implementing such a system.

- Software Licensing or Subscription Fees: One of the first aspects to consider is the software licensing or subscription fees. These costs can vary widely based on the vendor’s pricing model. For small SMEs that can utilize a standard cloud system, costs can start as low as 100 USD per month. This is often a per-account charge that allows businesses to scale their use of the system as they grow. On the other hand, larger or more complex operations may require more functionality and customization, which can drive costs significantly higher. Customized solutions often come with an upfront investment ranging from 150,000 USD to 300,000 USD, and can quickly surpass 500,000 USD depending on the extent of the customization required.

- Implementation and Integration Costs: Implementation and integration costs are another key consideration. These one-time fees encompass system setup and the integration of the software into your existing technological ecosystem. The complexity of your existing infrastructure and the number of integrations required can significantly impact these costs. Moreover, if you have unique requirements that necessitate further customization, the investment can escalate.

- Data Migration Costs: There are also costs associated with migrating existing data into the new system. These costs depend on the volume and complexity of the data to be transferred. A large amount of complex data may necessitate additional work to ensure that it is correctly and securely migrated, which in turn, increases the costs.

- Training and Support Costs: Training staff to use the new system is an additional cost that businesses must be prepared for. The complexity of the system and the technical competence of your team will dictate the extent of training needed. Furthermore, ongoing support for handling system updates, troubleshooting, and providing user assistance forms an essential part of these costs.

- Maintenance and Update Costs: Maintenance and updates, although often overlooked, are critical recurring costs. They ensure that the system remains functional, up-to-date, and secure. Factors such as the system's complexity and the vendor’s support policies can heavily influence these costs.

- Compliance Costs: Compliance is another significant factor. Ensuring the system aligns with relevant legal and industry standards is paramount, and these costs can vary based on the industry, region, and size of the business. For debt collection, stringent rules and regulations need to be adhered to, making compliance a substantial component of the overall costs.

- Costs of Downtime: Downtime costs, whether due to planned updates or unplanned system failures, should not be underestimated. These situations can lead to significant disruptions in business operations, leading to financial losses and, potentially, damaged relationships with clients.

- Hidden Costs: Finally, there may be hidden costs that are not immediately apparent, such as those related to system customizations, add-ons, or upgrades that become necessary over time. These unexpected expenses can add up, so it's important to consider them as part of the overall cost of the solution.

While the initial costs of a debt collection automation solution may seem high, particularly for custom solutions, it's important to consider the long-term benefits and cost savings. Debt collection software can drive significant operational cost savings and help prevent revenue leakage. In fact, for large companies, a custom system can deliver up to 760% ROI, with an average payback period of just 6 months.

Ultimately, the most expensive option is not always the best one. It's about finding the solution that best fits your organization's needs and budget. Thoroughly understanding your requirements and conducting a comprehensive cost-benefit analysis is key to selecting the right debt collection automation solution.

How to Select the Right Debt Collection Software

The decision-making process for choosing a debt collection software should be a carefully thought-out one. You need a platform that will cater to your specific needs and align with your business strategies. Here's a comprehensive guide to help you navigate this important decision:

- Understand Your Requirements: Start by comprehensively assessing your current debt collection operations to identify the areas that need improvement. Think about your organization's size, the kind of debtors you engage with, and the integrations that will be necessary for seamless operation. Special considerations related to your specific industry are also important. An essential part of this process is determining whether a readily available product will suffice or if a custom solution will be necessary. Custom solutions are recommended if your debt collection tasks are highly specific. For instance, if you need to prioritize debt collection based on unique criteria, process debtor responses and documents in specific languages, or define personalized collection strategies for high-value corporate debtors. Similarly, if seamless and cost-effective integration with your business-critical systems is a priority, if you have a large team involved in debt recovery and want to bypass costly subscriptions, or if you need a solution that can evolve easily with your growing business and shifting legal compliance requirements, a custom solution could be your best bet.

- Conduct Thorough Research: After clearly outlining your needs, embark on an extensive research phase to identify vendors that offer solutions matching your requirements. Delve into customer reviews, testimonials, and case studies to gain insights into the practical effectiveness of their offerings.

- Evaluate Cost and Features: Next, you should compare the shortlisted options based on cost and the features they offer. Look into aspects like data security, automation capabilities, scalability, custom reporting abilities, etc. The aim is to shortlist contenders for further examination or demos. Key factors to consider include:

- Integrability: Choose software that can easily merge with your existing CRM and account management systems. A solution like LeadSquared, which digitizes debt collection and offers CRM capabilities, can be ideal for growing businesses.

- User-friendliness: A complex interface can impact productivity and lead to errors. Select a software that is both easy to implement and use.

- Scalability: As your business grows, your debt collection software should be able to adapt to changing needs. It should effectively handle increasing case prioritization and credit risk prediction as your operations expand.

- Accessibility: The software should not only be user-friendly internally but also provide transparency and accessibility for your customers. Features like visibility into loan payment journey, outstanding principal amount, and loan tenure details can be beneficial.

- Customizability: Your business might not require all the features offered by the software. Hence, a tool that allows you to select features and customize workflows based on your requirements is important.

- Request for a Demo: Before finalizing the purchase, it's important to request a demo or test drive. This will provide firsthand experience of the software’s operation and ensure it meets all your requirements without any unexpected issues post-implementation.

- Collect User Feedback: Lastly, seek input from the intended users of the software. Their feedback will help gauge user acceptance and ensure smooth adoption once it's implemented. It's crucial to make sure the software meets their needs, as they will be the ones using it daily.

By following these steps, you can make a well-informed decision when choosing a debt collection software that is tailored to your specific needs and expectations.

To give you a starting point, we have gathered the following overview ofdebt collection software solutions:

Market Analysis: Exploring the Dynamics of Debt Collection Software Market

An undeniable requirement for digitization in the recovery process has seen the debt collection software market flourish, expanding by a noteworthy 10.2% annually. Currently, this burgeoning sector sits at an impressive €3 billion market value, with an enviable 80% gross profit margin. Predictions suggest the market could amass a stunning €6.7 billion by 2027, given the ongoing CAGR of 10.2%.

As a whole, the service market may be larger, but the dynamism, growth, and profitability of the debt collection software market is unrivaled. Increasing business acceptance and a profitable market space are fueling interest from entrepreneurs keen to break into this rapidly evolving sector.

Some of the key market characteristics include:

- Geographic market characteristics: Geographically, North America is at the forefront of the global debt collection software market. A robust infrastructure facilitating easy integration into various BFSI systems puts it in a dominant position, a trend likely to persist in the future. Meanwhile, Asia-Pacific is emerging as a significant player, its growth spurred by digital transformations and the growing readiness of consumers to adopt innovative technologies.

- Types of deployment: In terms of deployment, on-premise solutions presently hold sway in the market. Reasons driving this include a desire to safeguard sensitive data from cyber threats, monitor internal access to information, and exercise full control over costly software updates. However, cloud-based deployment is tipped for the highest growth, fueled by increasing acceptance among SMEs and large enterprises keen to reduce infrastructure investment while still accessing real-time operational and financial data.

- Key industries: Industry-wise, the financial sector claims the lion's share of the debt collection software market, a trend expected to continue as more banks digitize. Meanwhile, healthcare providers are forecasted to see significant growth due to increasing patient costs and unpaid debts.

Market Segmentation: Understanding Users and Software Types

Debt collection software caters to various users like debtor collectors, automated collection agents, debt portfolio managers, compliance officers, customer service representatives, data analysts, and fraud detectors, each with distinct needs and functionalities.

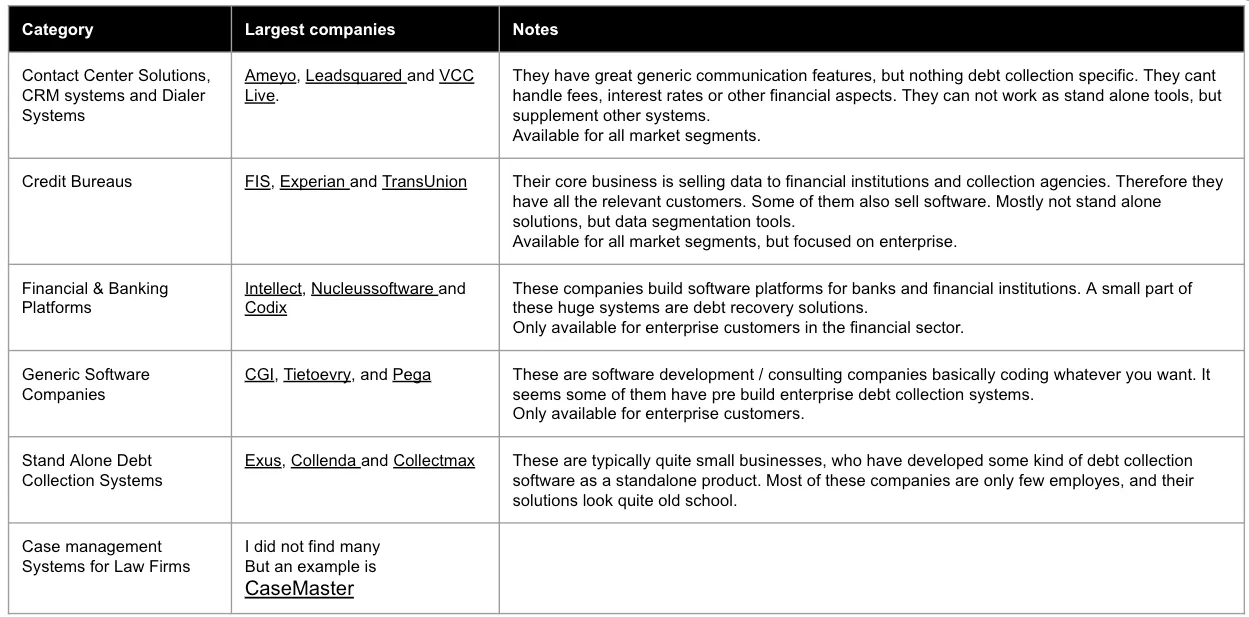

The market also exhibits diversity in terms of debt collection software types, making it seem intimidatingly complex. Broadly, we can classify the market into six sub-categories:

The debt collection software market is highly competitive with many players competing for a share of the lucrative industry. The debt collection software market seems to be highly fragmented. I have found more than 60 companies on Google that rank on the first pages with English websites. A Google search in german “Inkasso system” shows that there are plenty of local systems in Germany. In Denmark with 5 mio people, we also know about booth EG Inkasso, e-inkasso, and Debbie. Based on this I would estimate that there globally exist more than 500 different collection systems.

The systems are either developed by very small providers with 1-10 employees selling very old school systems, OR large companies selling complex enterprise systems.

An example of a very large but modern enterprise system is Qualco

An example of an SME system is Simplicity.

There are very few startups building debt collection systems.

There are quite a few like Billendo, YayPay, Upflow, and Kelleno building AR platforms. There are also a good number of digital / consumer-friendly debt collection service businesses like TrueAccord, InDebted, and PairFinance. Most funding has been going to consumer-facing lending platforms and securitization.

Therefore, the debt collection software market is highly fragmented with a few large companies dominating the industry and many small providers competing for market share. Additionally, there are a few startups that are building innovative solutions in this space, but they face stiff competition from incumbent players. Going forward, companies will focus on developing more user-friendly debt collection software solutions as well as leveraging machine learning and AI technologies for better results.

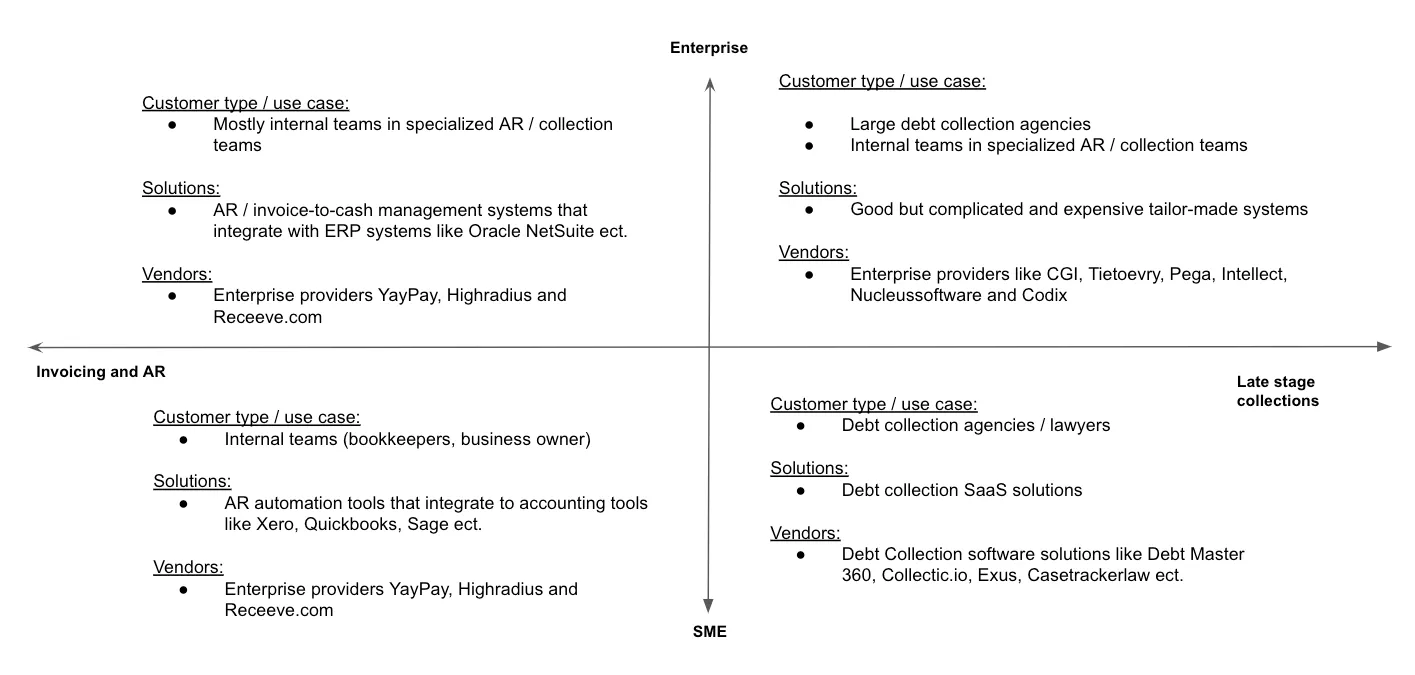

Another way to categorize the market is by looking at the customers going from SME to enterprise, and the stage of collection (invoice and AR management and late-stage collections on the other hand.

It is most common that businesses to manage the early stage of the collection process internally, and then outsource the later stages to their debt collection agencies or attorneys. This means that invoicing and AR tools are most often bought directly by the business and user for first-party collection, while the later-stage collection software is often bought by external parties working with third-party collections.

Based on this two-by-two matrices we can segment the market in the following way:

The key difference between the “early-stage” vs. “later-stage” collection software in terms of features is that in the early-stages the frequency is very high, and therefore the entire process should be automated and 100% integrated (two-way sync) with the ERP / accounting software the businesses used. Features that automate the payment reconciliation process, forecast cash flow, and decrease DSO are among the most important features in a system for early-stage collections.

For later-stage collection systems, the following features are critical:

- Calculate interest rates

- Calculate and add fees

- Manage payment plans

- Create legal documents

- Integrations to data providers such as Experian, Equifax, and TransUnion

- Advanced analytics to optimize collections strategies.

At the enterprise level, the main difference is that they require larger customer bases and a more comprehensive solution which includes self-service portals, automation of customer outreach, and robust customer segmentation and analytics.

Overall, the debt collection software market is becoming increasingly competitive as more companies enter the space, while incumbent players focus on innovating in order to stay ahead of the competition. Companies that are able to combine cutting-edge technology with user-friendly features and comprehensive integrations are likely to be the most successful in this space.

As the market continues to evolve, debt-collection software companies will need to focus on delivering comprehensive solutions that enable businesses and agencies to collect debt in the most efficient way possible, while also ensuring a satisfactory customer experience.

Trends: Market and Technology Evolution

Artificial Intelligence and Automation Infusion The implementation of automation in debt collection software is ramping up, cutting down on manual data handling, communications, and reminders. This not only reduces the workload of debt collection agents but also bolsters the precision of processes. Artificial Intelligence (AI) has begun making a notable impact on decision-making in debt collection strategies, analyzing historical data to predict the most effective collection approach and identify potential warning signs.

- Integrating Advanced Analytics and Forecasting: Advanced analytics capabilities are becoming a staple in debt collection software, providing vital insights into consumer behavior and gauging the efficiency of diverse strategies. This data-driven approach aids debt collectors in tailoring their methods and gaining a deeper understanding of their clients.

- Smart Omnichannel Presence: The mandate for debt collection agencies to engage customers via numerous channels has transitioned from a desirable trait in 2022 to a requisite in today's context. Now, communication rules specify how frequently an agency can reach out to a borrower, requiring the agency to use the borrower's preferred channel. Ensuring the high-quality data flow for effective interactions across various platforms is paramount, making omnichannel intelligence - integrated communication across multiple channels - a necessity. This promotes seamless exchange of accurate information and enables better assistance to clients based on previously shared details across platforms.

- Regulatory Compliance: Debt collection software is consistently updated to adhere to regulatory norms, such as the Fair Debt Collection Practices Act (FDCPA), ensuring that the collection practices are lawful and risk-free, mitigating potential legal confrontations from clients or authorities.

- Increased Transparency and Self-Service: There's been a surge in financial awareness among consumers, leading to a heightened demand for clarity on every transaction. Customers expect detailed explanations of fees, loan application requirements, and healthcare billing. To meet these expectations, debt collection agencies should maintain transparent policies and standardized call notes to help agents better understand and navigate conversations with clients.

- Enhanced Mobile Accessibility: With the rising ubiquity of mobile devices, debt collection software is evolving to be increasingly mobile-friendly, enabling debt collectors to remain connected with customers on-the-go.

- Rising Debt Forgiveness: Recently, the US government has forgiven select student loans rather than passing them onto debt collectors. Although this is not a common occurrence, other debts could potentially be forgiven in the future. This burgeoning trend requires careful monitoring as it could have profound implications for the debt collection business.

- Transition from On-Premise to Cloud-Based Systems: The debt collection software market is experiencing a noticeable shift from traditional on-premise solutions to cloud-based platforms. This move is inspired by the flexibility, scalability, and cost-effectiveness that cloud solutions offer. It also allows for seamless updates and enhancements, enabling businesses to keep up with regulatory changes and technological advancements efficiently. This trend significantly boosts operational agility, facilitating an improved debt collection process.

- Use of Blockchain Technology: Some debt collection agencies are beginning to explore the use of blockchain technology for its potential in providing a secure and transparent platform for debt transactions. While this is still an emerging trend, it could potentially revolutionize the way debt collection is managed.

- Integration with Other Business Systems: Debt collection software is increasingly being integrated with other business systems such as Customer Relationship Management (CRM) systems, Enterprise Resource Planning (ERP) systems, and accounting software. This integration provides a more unified and efficient platform for managing debt collections, allowing for seamless data transfer and enhanced visibility of customer accounts.

related articles about debt collection software trends:

Debt Collection Software FAQ

Get answers to frequently asked questions about debt collection software in our detailed FAQ section.

Debt collection software is a technology solution used by collection agencies, lenders, and businesses to recover outstanding payments. It automates tasks such as tracking debtor accounts, communication, debtor scoring, and scheduling payments, enhancing efficiency and compliance.

Benefits include streamlined debt collection, automated communications, advanced analytics, case distribution optimization, enhanced security, regulatory compliance, and simplified agent/user management. The software helps maximize collections while reducing operational costs.

Costs vary based on features, users, and vendor pricing models. Some charge a flat rate while others have per-user pricing or offer a subscription model. Always seek quotations and consider both immediate needs and future scalability.

Yes, most debt collection software offers integration capabilities with ERP systems. This enables seamless data sharing, thus enhancing accuracy and business process efficiency.

Debt collection software aids revenue recovery by streamlining collection tasks, automating communications, employing debtor scoring, and leveraging data analytics to formulate collection strategies. It helps identify high-priority cases and optimizes resource allocation.

Yes, debt collection software is a subset of financial management software. It's specifically designed to manage and optimize the debt recovery process, aiding organizations in maintaining their financial health.

Absolutely. Debt collection software can automate various communication aspects, like sending payment reminders, creating text-based reminders, and processing debtor responses, thereby enhancing operational efficiency.

Key features include comprehensive borrower management, robust case distribution, agent/user management, strategic debt planning, task management, communications automation, debt control, efficient debt enforcement, dispute management, advanced data analytics, and stringent security and compliance measures.

Yes, it leverages data like Days Past Due (DPD), credit repayment history, and due amounts to segment and score debtors. This aids in formulating personalized collection strategies.

Yes, most debt collection software includes robust security features like data encryption, multi-factor authentication, and role-based access controls to prevent data breaches and maintain system integrity.

The software uses real-time data analysis, debtor segmentation and scoring, and AI-powered recommendations to identify debts for collection and prioritize them based on aging, amount, and risk. It allows for scenario modeling and creates automatic schedules.

Yes, most debt collection software provides real-time tracking of received and outstanding debt repayments, thus enhancing visibility and control over the collection process.

It employs robust workflow automation tools to distribute cases based on collector availability, geographic location, and debtor priority. This ensures high-priority debtors are dealt with first.

Yes, most debt collection software is designed to adhere to global, national, and industry-specific regulations, including FDCPA, TCPA, and GDPR.

Yes, many debt collection systems can integrate with various CRM platforms, allowing for seamless data sharing and improved workflow management.

The software automatically captures and validates debt-related claims, aiding decision-making about claim approval or denial. Approved and denied claims are communicated to the debtor, streamlining the dispute management process.

Yes, it can automatically initiate debt enforcement actions, generate enforcement notices, create repayment arrangements, and assist in debt restructuring, purchase, sale, and bad debt write-off.

The software simplifies task management, automates numerous call center tasks, provides communication templates, and optimizes productivity with features like day planners, reminder notifications, and route guidance.

Yes, automated payment collections streamline debt repayment by managing payment schedules and offering flexible options, thereby reducing administrative burdens and benefiting both the debtor and the creditor.

It offers efficient call logs and notes management, prioritizing calls based on potential ROI, allowing for callbacks planning, recording conversations, and making notes for comprehensive follow-up. This enhances communication effectiveness with debtors.

Glossary of Key Debt Collection Software Terms

To navigate the world of debt collection software, it's crucial to understand the key terms used in this field.

A software type used by businesses to track money owed by customers after selling products/services on credit. AR software streamlines payment collection, improves cash flow, and provides a snapshot of a company's financial health.

Incorporating Artificial Intelligence in debt collection automates communication with debtors, optimizes decision-making processes, enhances recovery rates, and allows predictive analysis of repayment capabilities of a debtor based on past behaviors.

ADC is a modern approach to debt collection where software is employed to automate communication, payment reminders, tracking overdue payments, enforcement actions, thus saving time and increasing efficiency.

This refers to debt collection software's ability to automatically setup, manage, and adjust payment schedules, enabling consistent payment collections while minimizing human errors and enhancing operational efficiency.

This refers to the accounting process where debts deemed irrecoverable are removed from a company's balance sheet. Bad debt write-off impacts the overall profitability and requires accurate assessment to avoid financial distortions.

It involves managing the complete life cycle of a call center operation - right from initiating a call, managing the communication, resolving queries, to successful conclusion of calls and any necessary follow-ups.

This feature in debt collection software helps maintain detailed records of all interactions with debtors, including calls and notes, providing valuable context for future communications and strategic planning.

Specialized software used by collection agencies to automate the process of debt recovery. It offers tools for automating tasks, streamlining operations, and optimizing debtor communication.

Refers to automatic assignment of collection cases to agents based on parameters like priority of debt, geographical location of debtor, and agent availability. This optimizes resource allocation and improves recovery rates.

Refers to the automation of communication processes with debtors including sending payment reminders, processing responses, managing follow-ups, which leads to increased efficiency and better debtor engagement.

Debt collection software must adhere to various global and local legal and ethical regulations. Compliance is crucial to avoid legal penalties and maintain a good reputation among debtors and clients.

This software helps companies manage and monitor credit extensions to their customers. It assists in improving cash flow, minimizing bad debts, and providing a clear view of credit risk.

An approach in debt recovery that focuses on understanding debtor's circumstances and needs. This strategy promotes better debtor engagement, increased payment rates, and an overall positive customer experience.

APIs enable seamless integration of various external data sources with debt collection software, enhancing its capacity to consolidate, utilize, and analyze debtor information for strategic purposes.

This functionality within debt collection software improves agent productivity and efficiency by automating routine tasks, tracking performance, and providing necessary tools for effective debt recovery.

The use of advanced data analysis techniques in debt collection, helping businesses to form strategic decisions, optimize operations, identify trends, and predict debtor behavior, thus increasing recovery rates.

This software feature offers comprehensive oversight of all collection activities, including real-time tracking of received and outstanding repayments, allowing for effective debt management and strategic planning.

A specialized CRM tool designed for managing and streamlining interactions with debtors. It enhances efficiency in communication, provides personalized debtor engagement, and ultimately improves recovery rates.

This involves formal actions taken to recover debts, including sending enforcement notices, arranging payment schedules, and if necessary, escalating the case for legal actions.

This involves strategic planning for debt recovery based on real-time data analysis, debtor segmentation, and past recovery records, leading to improved recovery strategies and higher success rates.

A dedicated software used for automating and managing the process of recovering money owed by individuals or businesses. It streamlines operations, improves efficiency and increases recovery rates.

A complete software package that automates all aspects of debt recovery. It includes debtor communication, case distribution, analytics, reporting, compliance management, and more for optimal debt recovery.

This software feature allows seamless assignment, tracking, and management of tasks in a debt collection operation, leading to improved productivity and efficient resource allocation.

Refers to the use of advanced technology like AI and machine learning in debt collection. This enhances the efficiency, accuracy, and effectiveness of the collection process.

This functionality simplifies the management of users within the debt collection software, providing control over access, user roles, permissions, and tracking individual performance.

Using data analysis and predictive modeling to estimate the likelihood of debt recovery from a debtor. This helps in strategizing collection efforts, resource allocation, and risk management.

A dedicated software designed to manage and streamline the process of recovering debts. It automates communication, tracks payments, analyses debtor data, and provides insights for strategy planning.

This process categorizes debtors based on various factors like amount owed, repayment history, and risk level, enabling tailored collection strategies and maximizing recovery rates.

A type of software used for managing and tracking the process of debt settlement, which involves negotiating lower payments with debtors while keeping track of legal and ethical compliances.

This approach prioritizes the use of digital tools and channels in debt collection. It includes digital communication, online payment platforms, and the use of AI and machine learning for predictive analysis.

Allows debtors to manage their debts through a digital platform, making payments, negotiating settlements, or updating contact information. It enhances debtor engagement and reduces manual administrative efforts.

This feature in debt collection software captures and processes debtor disputes, enhancing operational efficiency, ensuring fair handling of disputes, and maintaining compliance with dispute resolution regulations.

This is a key metric in debt collection, representing the number of days a debt payment is overdue. DPD is used to track debtor behavior, manage collections, and assess credit risk.

A type of software that helps manage and guide field agents involved in the debt collection process. It streamlines tasks, optimizes agent routes, and improves productivity and efficiency.

A comprehensive software that helps manage, track, and analyze a company's financial operations, including debt collection, accounting, budgeting, forecasting, and reporting.

This software manages the process of recovering debts through legal actions. It maintains legal documentation, tracks court dates, manages communication, and ensures compliance with legal regulations.

This type of software is used by lenders to manage and optimize the process of recovering loan repayments. It automates communication, tracks repayments, and provides insights for better risk management.

Machine Learning is applied in debt collection to predict debtor behavior, automate decision-making, enhance recovery rates, and customize debtor interaction based on past patterns.

This refers to the use of digital and analytical tools in the debt recovery process. It involves data-driven strategies, automation, use of AI and machine learning, and a customer-centric approach.

This approach involves contacting debtors via multiple communication channels such as phone calls, emails, SMS, and digital platforms. This increases contact rates and boosts engagement.

Loans that are in default or close to being in default. NPLs are risky for lenders, so managing and reducing the number of NPLs is crucial in maintaining a healthy financial portfolio.

This type of software enables businesses to reach out to debtors across multiple channels like phone, email, SMS, or online portals, enhancing engagement and increasing recovery rates.

Software designed to automate and manage the process of collecting payments from customers. It facilitates seamless transactions, tracks payment status, and provides analytics for strategic decision making.

A feature in debt collection software that uses algorithms to call a list of phone numbers in a predictive manner, reducing agent wait time and increasing efficiency.

A specialized software used for managing and collecting debts related to real estate transactions, like mortgages. It provides industry-specific tools for communication, tracking, and analytics.

This refers to a predictive analytic method that calculates the likelihood of debt recovery from an individual debtor based on historical data, helping to strategize collection efforts.

The necessity for debt collection practices to adhere to laws and regulations set by governing bodies. Non-compliance can lead to legal penalties and reputational damage.

Advanced reporting and analytics features in DCS provide valuable insights, track key performance indicators, identify trends and make data-driven decisions for optimizing debt recovery.

The process of reclaiming unpaid revenues from customers. Debt collection software streamlines revenue recovery by automating communication, tracking payments, and providing actionable insights.

This method allows debtors to manage their debts independently through digital platforms, enabling them to set up payment plans, make payments, and negotiate settlements, reducing manual efforts and enhancing debtor engagement.

A method used in debt collection to locate debtors who are not reachable at the provided contact information. It uses data analysis, public records, and online tools to track down missing debtors.

Specialized software designed to manage and collect debts in the telecommunications industry. It includes features tailored to the specific needs of the telecom sector.

DCS's ability to integrate with other software and databases to enhance its capabilities, like ERP, accounting software, CRMs, providing a comprehensive debt management system.

Represents the total amount of debt that is currently owed by the debtor. Tracking this metric is crucial in assessing a debtor's financial status and strategizing collection efforts.

This refers to the automation of routine and repetitive tasks in the debt collection process, saving time, reducing errors, and allowing collection agents to focus on strategic tasks.

.svg)

.webp)